Truck-trailer manufacturers in 2022 saw production totals return to pre-pandemic levels, and most reported the year could've been even better: Demand remained strong as fleets posted big profits, but labor and supply chain challenges lingered.

Still, the lessons learned over the past couple of years made for smarter management and, in many cases, improved pricing as OEMs and their dealers successfully conveyed to customers the need to recover surging costs. Of course, when demand outpaces supply, fundamental economic principles play a role as well.

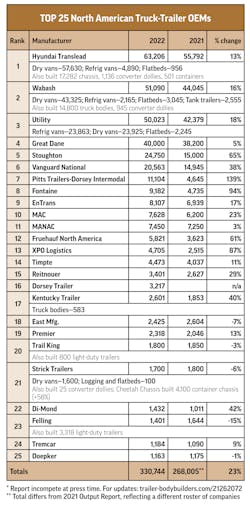

So, even with the challenges, manufacturers built nearly 325,000 trailers, a 20% increase from the year before and the eleventh consecutive year that trailer output has exceeded 200,000 units.

The trailer totals reported here cannot be compared directly with other domestic surveys that do not include Canadian and Mexican trailer plants. This survey does not attempt to report on the many small trailer manufacturing plants scattered throughout North America, so the total trailer build is somewhat larger than the Top 25 numbers reported here.

This Trailer/Body BUILDERS survey is made by contacting a member of the management team at each manufacturing company. The ranking of the companies does not necessarily reflect their relative success in terms of profitability or revenue received, but only the number of trailers produced. The dollar value of a trailer can vary greatly depending on the design, type of construction, materials used and quality level.

[EDITOR'S NOTE: In 2021, a group of domestic intermodal chassis manufacturers succesfully argued before the United States International Trade Commission that China was engaged in unfair trade practices regarding their chassis business in the U.S. As a result of tariffs imposed on Chinese chassis, domestic chassis production soared in 2022. However, in recent years the TBB survey did not include intermodal chassis in the production total. But because some manufacturers do not specify production mix, this report now includes some inconsistencies. We will work with respondents on a solution to ensure consistency in future reports.]

Below is how the individual trailer manufacturers reported their trailer production for 2022:

♦ Hyundai Translead of San Diego, California, produced 63,206 truck-trailers in 2022, an increase of 13% over 2021.

The total includes 57,630 dry vans, 4,890 refrigerated van trailers, and 956 flatbed trailers.

Hyundai Translead also built 17,282 container chassis, 1,136 converter dollies, and 501 containers not included in the rankings.

That’s 82,125 total pieces of equipment.

Production numbers were reported by Sharon Kim, marketing senior manager, Hyundai Translead. Trailers are built at the company’s plants in Mexico.

"While 2021 results were lower than hoped due to the supply chain challenges experienced across the industry, Hyundai Translead was able to add needed capacity to take advantage of the hard work of our extended supply partners in producing equipment for its customers," the company reported. "This added capacity serves as a springboard into 2022 as Hyundai Translead seeks to further satisfy customer requirements for equipment."

♦ Wabash shipped 51,090 new trailers in 2022, a 16% increase compared to the year before.

The total includes 43,325 dry freight vans; 2,165 refrigerated van trailers; 3,045 flatbeds; and 2,555 tank trailers. Wabash also built 14,800 truck bodies and shipped 945 converter dollies, not counted in the rankings.

“Although 2022 will go down as the most successful year of financial performance the company has achieved so far, the groundwork to enable this execution has been in progress since 2019,” said Brent Yeagy, president and CEO. “The changes to our strategy and the accompanying improvements to our organization that we've communicated in recent years have positioned us for this record performance, which we fully expect to expand upon in 2023."

Wabash reported a year-end backlog of a record $3.4 billion.

“Between cyclical and structural influences, we agree with third-party forecasters that equipment demand is likely to remain strong,” Yeagy said. “With under-buys in prior years and supply chain remaining as a constraint into 2023, implied demand for this year is still very likely to outstrip supply just on those specific factors alone.”

♦ Utility Trailer Manufacturing Co. produced a total of 50,023 trailers in 2022, up 18% from 2021. Of that, 23,925 were dry van trailers, 23,863 were refrigerated trailers, , and 2,555 were flatbed trailers.

“We broke records at our Paragould (Ark.) and Piedra Negras (Mexico) plants is 2022,” Utility President Steve Bennett said.

Of note in the Utility report: Dry van production edged above refrigerated units, the company’s product specialty.

“On the reefer side, TRUs have been a real struggle—by far, it’s our biggest problem, especially multi-temp units,” Bennett said.

As for pricing, the Utility dealer network “has been very understanding” as material costs soared in early 2022, Bennett noted.

“We've been very transparent with our dealers and our customers as to what occurred with steel and aluminum, and with all of our other components, like fiberglass,” he said. “But things have definitely calmed down.”

Utility currently has six trailer manufacturing facilities. Multi-temp refrigerated trailers are built in Marion, Va; Clearfield, Utah, and Piedras Negras, Mexico. Dry vans are manufactured at the Glade Springs, Va, and Paragould, Ark., plants. Drop deck platforms and curtain-siders are built in the Enterprise, Ala., plant.

♦ Great Dane Limited Partnership built 40,000 trailers in 2022, up 5% over the previous year.

“In 2022 we were able to show some growth year over year as we worked on managing supply chain and labor challenges. Customer demand was strong across all segments and that demand continued into 2023," Chris Hammond, EVP of Sales for Great Dane, said. "We expect further growth this year as we keep working hard to attract more people into the manufacturing sector while working closely with suppliers."

Great Dane also continued to build truck bodies, but those numbers are not in the trailer total.

"We saw continued demand from customers for our bodies in both dry bodies and refrigerated," Hammond added. "Our Fleetpulse telematics platform also saw growth in 2022 and now we have additional growth in 2023 as we see more fleets latching on to this modern technology to provide them with better insights to safely move more products around the country."

♦ Stoughton Trailers produced 24,750 units in 2022, a 65% increase from the prior year. This total primarily consists of dry vans trailers. Grain trailers, refrigerated trailers and intermodal container chassis are also included in the total.

“The groundwork laid in prior years has resulted in a dramatic increase in total trailer production [in 2022]. We opened our brand-new Waco manufacturing plant in January. Our new chassis line in our Stoughton facility quickly ramped up production volume. In April, our Evansville, Wisconsin, facility launched a fully robotic welding line for our chassis products—greatly increasing our production rate, product quality and employee safety," said Bob Wahlin, President and CEO of Stoughton Trailers. “We continue to optimize our automated component production and our existing assembly lines for both chassis and dry vans."

“Our large sales growth required the need to supplement our own production capacity. In Q1 of 2022, we launched a strategic partnership with a top-tier manufacturer in Mississippi to build chassis products. We are currently expanding the partnership to include the production of dry vans in early 2023. We expect 2023 to be another strong growth year as we drive greater performance from all our production streams."

♦ Vanguard National Trailer Corp. produced 20,563 trailers in 2022, a 38% increase from 2020.

Vanguard also built 3,297 refrigerated van trailers at its Monon plant and its West Coast plant in Moreno Valley, Calif.

♦ Pitts Enterprises Inc. DBA Pitts Trailers and Dorsey Intermodal built 11,104 trailers in 2022, reflecting a substantial ramp-up in chassis production.

“Intermodal is a cornerstone of the growth in our company,” JP Pierson, president of Pitts Trailers, , said. “We're committed not only to becoming a premiere intermodal supplier, but to maintaining our foothold in forestry and continuing to grow our lowboy presence.”

Pierson noted that the labor market has improved “slightly” and raw material costs are “leveling off.” The company also has continued to invest “significantly” in its manufacturing facilities.

“Backlog is still very strong—stronger than I want it to be. I'd love to see lead times from us come back down,” he said. “We’re full steam ahead.”

♦ Fontaine Trailer Co. manufactured 7,450 trailers in 2022, nearly doubling the previous year's total, the Alabama-based manufacturer reported.

“Flatbed demand outpaced the supply chain for the first half of 2022, and things began to stabilize some in the second half of the year. Fontaine has diversified our supply chain over the past 12-18 months and we feel we are in a much better place to supply the market than we have been since 2019,” Fontaine Commercial Platform President Alan Briley said. “Demand was strong coming into the early part of 2023 although there are some warning signals appearing that could indicate demand softening later in the year. Our business plan is for another stellar year, although the second half of the year is likely to be more challenging than the first half.”

“On the heavy haul side of our business, 2022 brought many changes including a branding change from Fontaine Heavy-Haul to Fontaine Specialized to more accurately reflect our expanding product line,” added Todd Anderson, Fontaine Specialized President. “While 2022 was among the company’s best years, Fontaine Specialized overall production was impacted by supply issues. Looking ahead, while supply chain issues appear to be improving, material cost increases remain as well other well-documented consumer headwinds. Nevertheless, Fontaine Specialized is forecasting only a modest impact to total trailer sales in 2023.”

♦ EnTrans International LLC of Athens, Tenn., reports shipments of 8,107 truck-trailers in 2022. This is a 14% increase from the previous year, according to Jake Radish, senior vice president of sales and marketing.

“We have seen significant rebound improvements in booking activity since H1 of 2021,” Radish said. “All business unit backlogs are up covering well into 2024 with most segments showing significant growth.”

EnTrans shipments include tank trailers built by Heil Trailer International of Athens Tennessee, and Polar Tank Trailer of Holdingford, Minnesota, as well as the heavy-haul trailers built by Kalyn Siebert of Gatesville, Texas.

EnTrans International LLC is owned by American Industrial Partners, an operationally oriented middle-market private equity firm. It also owns other oil and gas related companies such as JARCO, SERVA and Polar Service Centers.

♦ MAC Trailer Enterprises of Alliance, Ohio, built 7,628 trailers in 2022, a 23% increase over 2021 production.

In addition to multiple manufacturing facilities around Ohio, MAC builds tankers in Haslet, Texas and flatbeds in Davis, OK. The company acquired Portland, Ore.-based Beall brand tankers from Wabash National at the end of 2021.

♦ MANAC Inc. of Saint-Georges, Quebec, built 7,450 trailers in 2022, up 3% from 2021.

“We were hoping for a higher level of completed units, while not as bad as in 2021, the year did see a number of supply issues," Charles Dutil, president of MANAC, said. "Given the multiple challenges the team has faced, we view 2022 as a good year. With the present conditions and increased cost of capital, our outlook for 2023 is more prudent.”

♦ Fruehauf North America produced 5,829 units in 2022 a 61%l increase over 2021, driven by the launch of U.S production with a new dry van facility in Bowling Green, Kentucky. The total includes dry vans, flatbeds, dumps, chassis, and tank trailers built in the U.S. and Mexico.

“With challenges from covid, supply chain and startup labor issues, Fruehauf had a great year, all things considered,” Fruehauf Inc. President Tom Wiseman said. “Fruehauf is anticipating an even better year in 2023 as supply chain and labor issues continue to improve. We anticipate continued strong demand for product throughout North America in 2023.”

♦ XPO Logistics Trailer Manufacturing in Searcy, Ark., built 4,705 units in 2022, a an 87% improvement from 2021.

This includes 28-ft. trailers and 48-ft trailers and liftgate units, according to Paul Reed, manufacturing senior director.

XPO Logistics also builds van bodies and converter dollies.

♦ Reitnouer Inc. in Birdsboro, Pa., built 3,401 trailers in 2022, a 29% increase from 2021.

Business activity and operations have just about returned to pre-Covid normal, Bud Reitnouer, company president, reported.

“2022 was good—but it could’ve been great. The labor and the supply chain issues just really held us down," he said. "Sales were off the charts. We easily could have done 50% more than what we actually produced, we just couldn’t get there.”

♦ Dorsey Trailer LLC in Elba, Alabama, built 3,217 flatbeds and chip trailers in 2022.

“Everything is good,” said Trey Gary, president of Dorsey Trailer. “We always thank our dealer network and our dedicated partners and vendors.”

Operationally, the company has made capital investments to add a new paint booth, plasma tables, and various facility expansions.

As for 2023, Dorsey Trailer is on track for a 7% increase in production, Gary added.

♦ East Manufacturing Co. of Randolph, Ohio, built 2,425 mainly aluminum trailers in 2022, down 7% from 2021.

This company total includes 1,123 flatbeds; 886 dump trailers; and 416 refuse transfer trailers. East also built 45 truck bodies that are not counted in the trailer total.

♦ Di-Mond Trailers, based in Stoney Creek, Ontario, built 1,432 trailers in 2022, up 42%.

“2022 was a fantastic year,” President and CEO Chris Di Lillo said. “We all kind of woke up and realized we needed to be building trailers. There were challenges along the way that the industry never faced before, but it also did wonders for everybody, because it helped everybody get their margins up. And, hopefully, the big guys are smart enough today not to take every single deal.”

Di Lillo is also optimistic about the future.

“I think 2023 is going to be just as good as last year,” he said. “Nobody's got a crystal ball for 2024, but I know that we've got some key customers that are expecting us to be building at least 3,000 this year, and up to 4,000 by 2024. So we've got some pretty good growth ahead of us.”

♦ Felling Trailers Inc of Sauk Centre, Minn., built 1,401 trailers with a 10K or larger axle in 2022, a 15% decrease over the previous year, Patrick Jennissen, vice-president of sales and marketing, reports. Felling also built 3,318 light-duty trailers.

♦ Trail King Industries in Mitchell, S.D., built 1,800 truck trailers in 2022, a decrease of 3% from 2021. They also built 800 light-duty trailers with axles of less than 10,000-lb capacity.

“The biggest challenge we had was still some supply chain stuff early on, and then employment—that was our biggest issue: getting the people in and getting enough product out the door," CFO Gene Astolfi said. "Backlog wasn't an issue, and pricing seems to have somewhat stabilized."

However, the new year is beginning to look like late 2021 and early 2022.

“We were gaining some headway, but now some other supply chain issues have crept up, especially in brakes and all that," he said. “I don't know what's going to happen—it doesn’t seem like there's any reprieve anytime soon."

♦ Tremcar Inc. built 921 tank trailers and 223 tank truck mounts in 2021, with total Tremcar tanks of 1,194, up 9% from the year before, Melanie Dufresne, director of marketing and communications, reported.

“We could have built a lot more if we did have the labor to do it. There's only a certain capacity that we have,” Dufresne said. “I think things will get better. We're really over the whole pandemic thing. People are back to work. It's easier to recruit now than it was a year ago—so it looks pretty optimistic for the upcoming year.”

Even with the labor challenge, Dufresne was pleased that Tremcar had built 100 more tanks than the year before—and the company has expansion plans in the works.

“The market is good. The demand is there,” she said. “We have a lot of nice projects coming up. We want to double our capacity.”“The supply chain as a whole was difficult this year: Parts supplier deliveries delays and production time increased considerably,” Dufresne said. “Customers were having trouble getting truck chassis, for example, and this slowed tank sales for new truck mounts. Fluctuation of metal prices and employees out because of COVID-19 were also challenges in 2021. Let’s hope for a better situation in 2022.”

♦ Doepker Industries in Anaheim, Sask., built 1,163 truck-trailers in 2022, about the same number as the year before.

"While demand remained strong throughout the year for many of our trailer models, both supply chain and labor constraints impacted the growth we had projected at the beginning of 2022 for the year," Devin Leonard, vice president of sales and marketing, said. "Our strongest market continues to be the Super B Bulker trailers, but growth for 2023 is still projected in other sectors as well including gravel, flatdecks and heavy haul trailers."