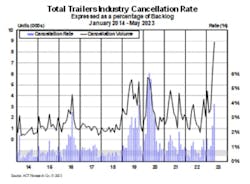

While the sky still isn’t falling, there are “more ominous clouds on the horizon” that bear watching moving forward, one being a “significant” uptick in trailer cancellations for a second consecutive month, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report.

ACT’s U.S. Trailers report provides a monthly review of the current U.S. trailer market, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments.

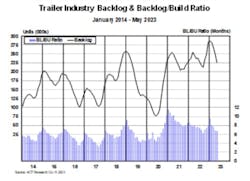

“While the broad-based nature of cancellations suggests the turn is starting to come into focus, this is juxtaposed against a backdrop of rather robust backlogs, even with declining orders,” Jennifer McNealy, ACT’s director of CV market research and publications, said in a news release. “The seasonally adjusted backlog-to-build (BL/BU) ratio gained 120 basis points month-over-month, to 8.0 months in May. Seasonal adjustment takes dry van BL/BU to 7.4 months and reefers to 9.1, so despite the improvement in build, this essentially commits the industry through year-end 2023.”

Regarding cancellations, McNealy added: “Fleet commitments remained mixed in May. Total cancels grew to 4.2% of backlog, higher than April’s 2.8% and significantly higher than March’s 0.9% rate. That said, while several segments were at or below 1.5%, dry vans rose to 4.1%, reefers are now at 6.5%, and flatbeds hit 4.7%.

“April’s increase raised an eyebrow, but we cautioned that one month does not a trend make. With two consecutive [and large] jumps in cancellations, both eyes are now wide open.

“Some trailer makers are telling us customers are cutting back on their anticipated order appetite for this year and next, and that fewer customers are on the sidelines to pick up whatever equipment/build slots become available.

“Clearly, the demand dynamic is shifting.”