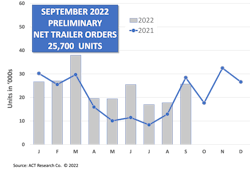

Preliminary trailer orders jumped in September, according to two research firms that track commercial vehicle markets. While both firms reported trailer orders surpassing 20,000, their details were different.

Preliminary reports from ACT Research have net trailer orders in September at 25,700 units, up about 45% from August—but still 10% lower than the same period last year. FTR Transportation Intelligence’s preliminary report pegged the trailer orders at 21,500 in September, up 29% month-over-month but down 24% compared to FTR’s data from September 2021. Final numbers will be available later this month. ACT anticipates a potential 3% variance in its numbers.

“With more 2023 order boards opening, September net orders rose in seasonal fashion,” said Jennifer McNealy, director of CV market research and publications at ACT. “As the OEMs open next year’s build schedules more fully, they are reporting that most of the build slots made available have been filled.”

She noted that while her firm’s numbers show a 45% jump in month-over-month orders when seasonally adjusted, the sequential gap is closer to 5% growth.

Most trailer manufacturers, especially those in the van segments, still must manage production weekly as component shortages continue to hinder production, according to FTR. Despite the relatively lackluster order environment over the past three months, monthly build levels remain strong, the firm reported.

“In the retail market, dealerships still can't keep enough stock to meet demand,” according to Charles Roth, commercial vehicle analyst for FTR. “At the same time, large carriers haven't been able to keep up with replacement cycles, which has driven the level of pent-up demand for new replacement units to above-average levels. While net orders have historically followed a seasonal pattern, the past two years have fundamentally changed how OEMs manage their build slots.”

As component shortages continue amid price uncertainties, trailer manufacturers are less likely to book orders as far in advance as they did use to, Roth said. “Most manufacturers are trying to avoid having to push orders back or finish units offline as this has impacted not only their operations but also their customers,” he explained. “The order volumes could be viewed as OEMs filling in the 2023 build slots only when they are confident that they have the necessary visibility required to fulfill them.”

ACT’s McNealy added that “some trailer manufacturers are reporting expectations that when they do open the remainder of their 2023 order boards in the next few months, those spots will also fill rapidly, despite no firm pricing available at this point.”