For Steve Latin-Kasper, senior director of market data and research for the NTEA, the work truck industry’s economic overview and market forecast could be summed up in a single word: Deceleration.

Latin-Kasper outlined his equipment outlook during Work Truck Week 2024, where the senior director explained that the economic slowdown is not necessarily a herald of negative things to come for the industry.

Overall expectations

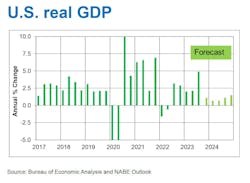

While Latin-Kasper’s theme was deceleration, this does not mean he anticipated a recession for the industry, especially as the U.S. GDP improved marginally in 2023. Latin-Kasper emphasized that he expects U.S. GDP to pick up again in 2025 since the labor market has remained stronger than forecasts previously expected.

While the labor market is still tight, current unemployment in 2024 is about 4% instead of 5%, and the NTEA does not expect any large changes from that value heading into 2025.

“The tight labor market is going to remain with us simply because of demographic imbalances,” Latin-Kasper explained. “All 3.5-4 million boomers retiring a year is not even close to being matched by Gen Z entering the workforce.”

Additionally, inflation remains a large part of the problem. While the NTEA at first thought interest rates were going to decrease in March 2024, now Latin-Kasper stated that there aren’t likely to be any interest reductions by June.

Chassis and upfitting

However, despite the labor market, interest rates, and inflation, the NTEA found that commercial truck chassis, tractor, and van sales have largely continued to climb back toward 2019 levels.

This is despite how 2019 was an outlier year, Latin-Kasper stated, particularly for commercial van sales due to large shipping companies, such as Amazon, placing gigantic orders.

But this doesn’t change the fact that the NTEA anticipates that there will be slow, but steady growth throughout 2024, and accelerated sales in 2025.

“As you can see, the previous peak was in 2019, which we just aren’t that far off from,” Latin-Kasper commented. “So that’s your expectation for planning going forward if you have anything to do with upfitting.”

However, the senior director did caution that upfitting tractors wasn’t as promising going into 2024, even though they aren’t “falling that far off pace.”

Latin-Kasper helped explain this lag by delving into the American Trucking Associations’ (ATA) freight shipment index. His comparison of NTEA Total Straight Truck Class 2-8 truck chassis sales and ATA freight shipments showed that all freight shipments are currently below zero, but have finally reached their trough.

Latin-Kasper anticipates that these shipments will then increase throughout 2024, with the ATA’s numbers and the NTEA’s intersecting in the first half of 2024.

Shipments and sales

While chassis sales showed signs of recovery, Latin-Kasper did note that supply chain disruptions still led to significant negative impacts for Class 2-8 truck chassis sales and shipments in 2023.

“When the chassis started coming out of quarantine, the OEM chassis builders were also ramping up production,” he said. “Shipments got way ahead of sales, and the primary reason for that was the labor shortage.”

Class 2-8 sales and shipments wrapped up in 2023 only .2% ahead of 2022, largely due to the decline in sales and shipments for Classes 2-6 chassis and supply chain disruptions.

Read more: Ritchey named 60th NTEA board chair

“When the OEM chassis builders figured that out, the shipment growth decelerated rapidly, and we now have shipments and sales growth roughly balanced, which is what we would generally like them to be,” Latin-Kasper explained.

And, on the positive side, overall factory shipment growth rate from when chassis manufacturers came out of quarantine “led to a fairly substantial growth rate acceleration, and also led to some really good inventory numbers through most of the industry’s weight class segments,” he observed.

Lead delivery and backlog

With this overall increase in inventory, Latin-Kasper said that the market has seen some improvement in chassis delivery lead times.

“We’re averaging a little less than 12 weeks in chassis delivery lead time,” he explained. “And that was true for the complete vehicles to the pickups, vans, and tractors.”

Frame rails, too, have become an issue, which could lead to small extensions in chassis delivery time in the first half of 2024.

But despite this, Latin-Kasper reported that backlog and quoting activity was relatively strong heading into 2024. According to the NTEA, 50% of manufacturer respondents and 30% of distributors had 90 days or more of backlogs. Meanwhile, 40% of overall respondents reported that quoting activity increased since June 2023.

Materials and components

Finally, Latin-Kasper stated that he was not worried about aluminum and steel prices overall. While China’s economy, as the largest provider and consumer of aluminum and steel products, has suffered an unknown amount of deceleration itself, this means that buyers in the U.S. aren’t likely to see any “upward pressure” on aluminum prices any time soon.

Cold-rolled sheet and strip steel prices, while volatile over the past couple of years, are also likely to begin to decrease as well, as last year’s strikes have been resolved and plants closed for maintenance have reopened.

Latin-Kasper concluded that the work truck industry will continue to slow down throughout the coming year before picking up again in 2025, despite ongoing pressure from supply chain issues and political shifts in Eastern Europe and the Middle East.