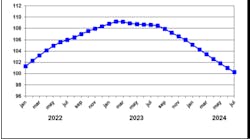

These days, fleet purchasing and specification decisions are made as part of a very sophisticated process with a great deal of information—and it pays off significantly, according to Stu MacKay, president of MacKay & Company.

In the session he led, “Meeting the Parts and Service Needs of Today’s Fleet,” he assembled a panel with a combined 227 years of fleet management experience involving 60,000 power units and 130,000 trailers—representing over $500,000 of parts in the aftermarket and $1.5 million in service labor.

The panel included: Brian Antonellis, CTP fleet director, PepsiCo; Dwayne O Haug, principal owner, Dwayne O Haug Consulting LLC; Lee Long, director of fleet services, Southeast Freight Lines; Gloria Pliler, director of parts procurement, Swift; Scott Perry, chief technology and procurement officer, Ryder Systems Inc; Dan Samford, AEMP executive advisor, Peak Performance Asset Services; Roy Svehla, senior manager of fleet maintenance, Republic Services; and Tom Moore, senior VP, National Private Truck Council.

MacKay: What have been the most significant changes in your truck and trailer maintenance practices over the last five to 10 years, and what has driven these changes?

Long: Over the last few years, we’ve really realized that aftertreatment has been taking a lot of our time. As a result, we’ve had to try the anti-emissions standards that the OEMs have set on us. We realized that the original predictions of 400,000 miles before DPF cleaning was supposed to happen was actually about half of that when they first came out. The maintenance practices we’ve gotten into were taking what the best practices of the manufacturers were and seeing what the real world was telling us, and adapt to that. Fortunately we’ve come full circle and got a good grasp on that system and worked towards that end. The other thing that we really came to see is meeting fuel standards. We’ve gone in and looked at all the aerodynamics on the truck, the spec’ing of trucks, and aerodynamics on tractors, the closing of the gap between the tractor and trailer. A lot of that stuff has helped us improve our fuel economy. So we’ve looked at a number of different things and looked at fuel testing to see what was most practical to our fleet.

MacKay: Basically, the changes you’ve experienced have been driven by emissions equipment and its ability or inability to do what it said it was going to do when you were mandated to put it on?

Long: That’s correct.

Svehla: Probably the most significant thing we’ve done over the last, say, six years is we’ve extended our oil intervals out in excess of 300%. Along with that, we’ve also changed the type of oil. And also changed the grade from 15/40 to 10/30. The reasons for that were economic and environmental. So it’s kind of a delicate balance we’re trying to achieve. We’re trying to get the most for our oil power but also trying to get the most out of our equipment life as well. So far, it’s been working out pretty well. We’re not done. We’re always looking to see what we can do.

MacKay: Your operation is very much short haul because of the nature of the refuse business. I suppose landfill runs and things like that. Lee has one set of operating circumstances he has to deal with. How far have you stretched those drain intervals?

Svehla: The bulk of our trucks are 900 hours, and some at 1350. Our OEM recommendations are between 350 and 300. So far we’re doing OK. The second part, as Lee mentioned, is with introductions on emissions systems. We’ve had to incorporate them into our PM systems as well.

MacKay: Gloria, your operation is different from Roy’s refuse business. You’re long-haul truckload, basically. What’s changed in the last few years with your maintenance activities?

Pliler: We don’t do DPF maintenance, so to speak, because we have a longer length of haul. We’re seeing that due to the complexity of electrical systems OEMs are putting into our trucks, we’re finding we have to use dealerships more than we had to in the past. So we put in a large investment in brick and mortar. We have about 60 shops across the nation, and we have taken on dealer technicians into our shops, so they work with dealerships and are working in our shops and we can control our down time a little better. It is a challenge to find the technicians.

We generally don’t pay as well as dealerships do, so dealerships get the technicians first.

MacKay: Dan, construction companies have a different set of problems.

Samford: Exactly. The construction world is a whole different animal. We have a lot of idle time, which creates a whole other set of problems for DPFs and the emissions side, which translates into time we have to basically do active regens. It’s a challenge we’ve been finding since the inception of emissions on off-road equipment, which came after the trucking world. The trucking world was exposed to it first. But we avoided it as long as we could. It’s been mandated upon us. Telematics has helped. We are able to target DPF percentages, so we can look at percentages the OEMs have that can give us a reading on that, so we can schedule those type of things a little closer as well as maintenance, because hours don’t necessarily reflect well for maintenance when you have a lot of idle time, as well as miles. If it’s a unit that runs 10 mph, it doesn’t reflect good either way, so we rely heavily on an analysis with a baseline.

MacKay: Tom, private fleets. Your guys haul their own stuff. Most of the rest of these guys haul somebody else’s stuff. So you have a different set of operating characteristics, in terms of feedback from your members and how their maintenance practices have changed.

Moore: I would categorize it as a couple of different trends. First, they’re using date much more heavily to manage the appropriate times to buy and sell that equipment and determine the total cost of ownership. They’re analyzing many more factors. From a maintenance standpoint, they’re trying to really get more life out of the equipment. But to do it on more of a predictive basis. So data analytics are driving a lot of their decisions. But it is a double-edged sword, because often times they don’t have the capacity internally to manage all the data that’s coming in off the equipment. Their technicians may not be as advanced. So over the past few years, we’ve actually seen a trend of more private sources outsourcing their maintenance. Right now, we have about 20% of our fleets that handle the majority of maintenance, about 40% outsourcing the majority, and the remainder is a combination strategy.

MacKay: Are they leasing those vehicles or simply outsourcing the maintenance?

Moore: It’s going to be a combination. About 40% of our members do lease. But of those folks, actually we’re seeing more of a prevalence to outsource beyond that 40%.

MacKay: That sounds to me like a meaningful shift in a relatively short period of time.

Moore: Absolutely. Finding technicians is not easy. Paying the technicians as Gloria has mentioned is a real challenge. Also the level of training and the technological ability of the technicians.

MacKay: Is there a trend to the OE channel, to a leasing company, to an independent? How do you see it allocated on the outsourcing?

Moore: The answer is yes. The biggest one has been to the OE channel in terms of building the outsource maintenance. ♦