THERE’S no need to get depressed over the projected decline in sales for trucks and trailers in 2016.

True, FTR is forecasting medium-duty sales to decline 3.5% in 2016 to 110,000, Class 8 to decline 14.7% to 215,000, and trailers to decline 8.5% to 279,000.

But those are still healthy numbers, and they are augmented by projections of steady increases in aftermarket demand, according to John Blodgett, vice president of sales & marketing for MacKay & Company.

Check out the predicted numbers for the US aftermarket for trailers and medium-duty and heavy-duty trucks: $30.5 billion this year, followed by years of $32.5 billion, $34.6 billion, $36.8 billion, and $38.6 billion. That’s an annual increase of 5%, which comes out to annual growth of 3% after 2% is removed for pricing.

It’s nearly the same story in Canada: $4.9 billion this year, followed by years of $5.2 billion, $5.3 billion, $5.5 billion, and $5.6 billion, for annual growth of 1% after pricing is factored in.

All the trucks and trailers that have been sold in the past few years will have to be serviced. And that’s big business.

The total aftermarket in 2015 for Class 6-8 trucks, trailers, and chassis was $107 billion: parts, $30 billion; tires, $16 billion; lubricants, $2.5 billion; and service labor, $58.5 billion (based on a value of $100 an hour for service work that gets outsourced and also for work fleets do in-house).

“When you add in $58.5 billion to the rest, it makes a total aftermarket of $107 billion,” Blodgett said. “That’s a pretty big number.”

Using an average length of 15 years for a truck, here’s the annual cost to maintain a Class 8 truck right now: parts, $7200; tires, $2900; lubricants, $600; and service labor, $9900.

“We had 250,000 in retail sales of new Class 8 trucks this year, and each of those will—over the next 15 years, in today’s dollars—generate about $21,500 worth of aftermarket parts, tires, lubricants, and service labor opportunities,” he said.

John Blodgett, MacKay

“There’s a sweet spot where a vehicle gets in during the seven- to nine-year time frame, and some of the major components need to be overhauled and replaced. The average gets higher for those years—about $30,000.

“For a Class 8 truck, there’s about $345,000 spent over 15 years. Those trucks generate a huge amount of aftermarket opportunity. It’s amazing how big that is over that period of time.”

The 2015 US operating population was 9,237,000 vehicles: 4.7 million trailers, 2.9 million Class 8 trucks, and 1.4 million medium-duty trucks.

By vocation in Class 8: for-hire carriers, 30%; construction/mining, 17%; private, 17%; lease/rental, 11%. In Class 6-7: school bus, 25%; private fleets, 17%; lease/rental, 13%; construction/mining, 11%; and agriculture, 10%. Blodgett said trailers are driven by who owns the tractors in the Class 8 market, and for-hire carriers own the biggest portion (61%), followed by lease/rental (16%).

Replacement demand is driven by Class 8 vehicles (71%), followed by Class 7 (16%), Class 6 (7%), and trailers (6%).

“Class 8 trucks run more miles and have more expensive parts, so that’s a big chunk of that market,” he said.

By vocation: for-hire carriers, 30%, private fleets, 20%, construction/mining, 13%; lease/rental, 12%; agricultural, 6%; owner-operators, 6%; and school buses, 5%.

In 2014, the channel of distribution for Class 6-8 trucks, trailers, and chassis accounted for $28.8 billion, broken down like this: OE channel network, 46%; heavy-duty distributors, 17%; independent garages, 11%; engine distributors, 9%; specialists 7%; auto parts, 4%; and others, 6%. Last year, it accounted for $30.1 billion, and the OE channel network and heavy-duty distributors each had gained 2%, while independent garages had lost 2% and engine distributors and specialists each had lost 1%.

“Markets have grown a little in the last year,” Blodgett said. “Last year, we talked about $26 billion. Now it’s gone to $30 million, and that’s in part because we added a lot of components in the last year. The OE dealer network has increased in share in part because we added emissions-related components.”

In 2014, new parts accounted for 71%, followed by factory remanufactured (16%), local rebuilt (6%), operator repair (3%), OE rebuilt (3%), and used (1%). Last year, new parts had picked up 3%, while factory remanufactured, operator repair, and OE rebuilt all dropped 1%. Blodgett attributed the increase in new parts to the addition of emissions-related components.

David Kalvelage, manager of IT and database services for MacKay & Company, said Canada’s 2015 operating population was 1,118,000 vehicles: 350,000 Class 8, 190,000 medium-duty, and 573,000 trailers and container chassis.

In Class 8, the for-hire carrier is only 23% (7% lower than in the US), and the agricultural segment is 17% compared to 8% in the US, and 34% for medium-duty, which is three times the percentage in the US.

“Where are parts being sold?” he asked. “It’s pretty similar to the US—a little bit higher to the OE channel, 50% versus 48% in the US. The heavy-duty distributor is doing less, 16% versus about 19% in the US. The independent garage is doing better at 14% versus 9% in the US.”

Blodgett said MacKay surveys Mexico every four years, and the “process is a lot more difficult. We have to physically meet with fleets and ask about service from bumper to bumper, and they’re not as open as in the US.”

In 2015, the operating population in Mexico was 784,000 vehicles: 453,000 Class 8, 241,000 trailers, and 90,000 medium-duty.

“In Mexico, heavy-duty vehicles do most of the miles and have a bigger population, representing 60% of that market,” he said. “Transit and coach buses make up 21%, medium-duty 15%, and trailers 4%. For-hire carriers account for 37% and buses 21%.”

“This has been a process over time. We’ve been studying and doing aftermarket surveys in Mexico since the mid-1990s, and we continue to describe and define that better. There are always difficulties with terminology and what goes on down there, but of the $3.4 billion aftermarket, independent garages get 32%, and HD distributors are at 30%, and truck dealers 15%.

“Now that independent garage is a little different bird than what we see in the US and Canada. We found out over the last couple of studies that even though independent garages, or independent mechanics in some cases, can do 32% of service based on the value of parts, quite often the fleet or owner of the vehicles is buying parts and giving them to that independent garage or independent contractor to do that work. So even though the independent garage is turning the wrench, they’re not always responsible for where those parts get purchased.

“The other challenge we have is the auto parts segment. The auto parts term can mean everything from an HD distributor to an AutoZone in Mexico. So we have to do more work to segment that out.”

He said there is not much remanufacturing yet—only 2%.

“There’s a big ownership deal for components, and they’re not willing to give that up,” he said. “The majority of parts (96%) are replaced with new components.”

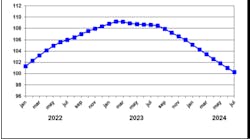

Kalvelage said MacKay started its Aftermarket Index in 1997 with six companies. Now there are 19 companies with data back to 2009. It represents about $2.5 billion of US sales, or about 10% of the total aftermarket. Data is broken out by US, Canada, and Mexico, and by OE and independent channels. There is summarized data—no individual company data is shown—and results are available to participating companies.

“It’s a good indicator of what’s going on in the aftermarket,” he said. “It’s something else complementary you might be interested in when looking at the aftermarket.”

Aftermarket Index participants: Bendix, BorgWarner/Remy, CVG, Dana, Eaton, FederalMogul, Firestone, Grote, Haldex, Horton, Meritor/Euclid, Marmon, Phillips Industries, SAF/Holland, SKF, Stemco, Tenneco, Truck-Lite, and ZF.

The 2015 Aftermarket Index was up 0.5% in the US. By channel, the OE was up 0.7% and independents up 0.4%. In Canada, independents were down 4%, OE up 0.1%, and a 2.4% decline overall. In Mexico, OE was down 3.1% and independent up 16.8% for an overall gain of 9.2%. ♦