Trailer orders came in with the lowest totals of the year in June, a seasonal result that industry analysts fully expected as production remains constrained and orderbooks are largely closed. Still, 2022 totals have gained a lot of ground over the more challenging environment from a year ago, and 2023 is on track to be among the biggest production years in industry history, according to the preliminary June reports from FTR and ACT Research.

FTR reported preliminary trailer orders fell back in June to 14,400 units; that’s down 23% from May but up 20% from the year before. Trailer orders for the past twelve months have totaled 265,000 units.

The order number for June “met expectations,” as OEMs have filled most of the available build slots and are not yet booking orders for 2023, FTR noted. Orders should rise “substantially” in the fall when commitments for next year are firmed up.

“The order numbers are consistent with traditional trends entering the summer months. However, usually the numbers drop because fleets have ordered all the trailers they need for the year. This time, the orders are falling because the OEMs have limited build slots available due to ongoing supply chain disruptions,” Don Ake, vice president of commercial vehicles for FTR, said. “The fleets need more trailers, and the OEMs want to increase production, but some component parts remain scarce. Orders should remain sluggish throughout the summer.”

Indeed, the OEMs are holding onto an “enormous amount” of fleet commitments for 2023, Ake added. However, unstable commodity costs and other variables make quoting prices “difficult” right now.

“These commitments should begin turning into booked orders beginning in September, and there is the potential for record order volumes in the fourth quarter,” he said.

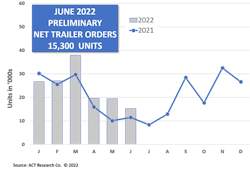

Similarly, ACT Research tallied 15,300 net trailer orders in June, down about 21% from the previous month, but up a “significant” 33% from the same month last year, according to the preliminary report. Final June results will be available later this month.

“With 2023 orderboards only partially open, it is no surprise that net orders in June were the lowest they’ve been so far this year,” said Jennifer McNealy, director CV market research and publications at ACT Research. “That is simply part of the cycle. However, it is equally no surprise that net orders continue to best 2021, given the continued supply-chain constraints, both in materials and labor, that trailer manufacturers are facing.

“With long backlogs, fleets still want to make sure their orders are in queue, regardless of when they will be filled.”