Metalforming manufacturers’ forecast predict slower economic activity

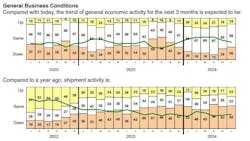

The Metalforming manufacturers’ forecast for economic activity over the next three months has continued to dip, according to the June 2024 Precision Metalforming Association (PMA) Business Conditions Report. Prepared monthly, PMA’s report provides an economic indicator for the next three months of manufacturing, sampling 91 metalforming companies in the United States and Canada.

“The June survey confirms that PMA members are seeing a slowdown in economic activity, which tracks other recent reports for the manufacturing sector that are reporting a contraction in activity,” said David Klotz, PMA president. “Our members are reporting a general sense of uncertainty over industrial demand, the election outcome, and whether tariffs will go up in 2025 and taxes will go up in 2026. The current environment makes it difficult for downstream companies to plan and respond to their customers’ concerns over similar uncertainties in the markets and over who will be in control of Washington after the November election.”

PMA’s June report shows that only 14% of the manufacturers responding to the survey predict an increase in economic activity in the next three months (compared to 19% in May), while 30% anticipate a decrease in activity (increasing from 26% in May). Another 56% expect no change in activity (compared to 55% last month).

Read more: FABTECH 2022 draws nearly 30,000 to Atlanta

Metalformers also forecast a decline in incoming orders, with only 24% of survey respondents expecting an increase in orders during the next three months (compared to 32% in May), 50% predicting no change in orders (compared to 49% last month) and 26% anticipating a decrease increase in orders (compared to 19% in May).

Current average daily shipping levels remained steady in June, with 46% reporting no change in shipping levels (compared to 49% in April), 25% reporting an increase in levels (up from 21% last month) and 29% reporting a decrease in levels (compared to 30% last month).

Lead times rose in June with 10% of metalforming companies reporting an increase in lead times (compared to 7% in May). Eight percent of companies had a portion of their workforce on short time or layoff in June (compared to 12% in May), while 40% reported that they are currently expanding their workforce (increasing from 35% in May).

The report’s full results are available here.