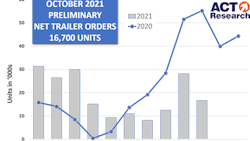

October preliminary net trailer orders of 16,700 units were down approximately 40% from September and off 70% from last year’s peak order month, according to ACT Research’s State of the Industry: U.S. Trailers report provides Final October volume will be available later this month.

“It’s obvious that market uncertainties are preventing OEMs from commencing the industry’s normal order season. Challenges of supply-chain bottlenecks, labor shortages, and material and component prices are forcing OEMs to proceed very cautiously,” said Frank Maly, director CV transportation analysis and research. “Initial reports indicate that October build rates were similar to September. So OEMs, while able to maintain production levels and manage backlog horizons, continue to be unable to ramp efforts to meet the extremely strong and growing fleet demand for additional trailers.”

Additionally, ACT Research’s recently released Transportation Digest adds that the front-and-center concerns of the commercial vehicle industry at the moment are supply-chain constraints, as well as the inflationary ramifications that flow from them.

“In addition to the front-and-center supply-chain constraints, ACT also remains focused on key industry demand drivers,” said Kenny Vieth, ACT rresident and senior analyst. “The Cass Shipments Index has been on an upward track for almost a year and a half, which is no surprise, given the shift in consumer spending from services to goods during the pandemic.

“The nationwide focus on the supply-chain in the business press and the general media is unprecedented. And most of the links in supply-chain nodes from ports to factories to distribution centers to retailers and households are trucks and trailers.”

Vieth continued by explaining some of those demand-side factors.

“Spot freight rates for dry vans, flatbeds, and reefers reached highs in September. Higher diesel prices enhance the value proposition of today’s fuel-efficient new trucks, as fuel savings translate into bigger ROI numbers - especially for long-distance hauls,” he said. “Reviewing forecast risks, the two most visible and worrisome unknowns in the near term are 1) ongoing supply challenges for OEMs and suppliers impacting industry production, and 2) the threat posed by COVID, especially if holiday gatherings are a catalyst for another wave. We also note rising risks in China, from the financial risks of over-leveraged real estate, to rolling power outages, to geopolitical issues like environmental policy and increasing tensions with Taiwan.”