The trucking market is “very vulnerable” because of an ongoing and deepening capacity crisis, according to Noel Perry, senior consultant for FTR Associates.

In today’s State of Freight webinar, he said he suspects that 99% active truck utilization is the break point after which the market has stress—and that was reached in the fourth quarter of last year.

“And sure enough, the market has begun to show signs of stress,” he said. “It’s a pretty strong hypothesis we are at the point where the market is very vulnerable.”

Will it last awhile?

He said that in 2013, 0.9% of the capacity utilization change was from economics. The 2014 base case has 3.5%.

“Our base case has weak freight multipliers,” he said. “This year, freight growth will slow enough that the market should be catching up with capacity, and capacity utilization should fall from 99 to 96.5. The base case has little pressure from trends.

“There is significant upside this year. If we get growth like we had last year, rather than easing the capacity shortage, we’d get an increase. The other factor is the imposition of regulatory drag by FMCSA. There were three percentage points of tightening capacity utilization, particularly with Hours of Service in July. When you add that to economics, we get a total increase of 4% in capacity utilization. That’s why went from 95% to 99%.

“There is upside both in terms of the amount of regulation and economics, and if they were to occur, we would get something like a 3% increase, which would take us over 100%.”

He said seasonals will add a 2.5% increase in capacity utilization above trend, to 102%.

“Seasonals tell us the problems we have now are enough to keep stress for most of the year,” he said. “Next year, assuming there’s no bad winter, things will soften. Then we’ll get back into a danger area in the second and third quarters.”

He said between 2004 and 2007, price growth lingered well after the capacity crisis subsided.

“It’s likely that the price we have now will last for a while and probably grow in 2015,” he said.

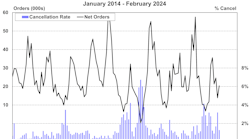

The latest price data: spot internet truck stops are up 15% year-over-year, spot DAT is up 15%, contract ATA 4%, and contract cass 5%.

“We expect contract rates will steadily increase through 2014,” he said.

Since January 2011, the price of diesel fuel has not changed.

“If the political situation in Iraq, Iran, and India stabilizes, we could have a fall in price,” he said.

Perry said OEMs have plenty of capacity and will expand if orders go up, but there is strong evidence that in the long term, it’s getting harder to find drivers.

“The real big issue is carriers’ long-standing—at least since the turn of this century—policy to be very conservative in adding drivers,” he said. “They tend to do so after the fact. HOS hit in July of last year and problems showed up in the fall. The response to that is not likely to occur until this year. So it’s really management behavior that’s causing shortages right now.”

Perry said the impact of electronic logging devices will be huge in the short term.

“Even the careful carriers have discovered that drivers, like all of us, have been cutting corners,” he said. “When you have an electronic log book, it documents when you cut that corner. That’s 5-6% in productivity.

“When electronic log books become universally required, that will be a major reduction in productivity in the short term. We don’t think it will be universally required to be installed for three or four years. Ten years from now, electronic log books will be a big positive because once you know exactly where the driver is and how much time he has, you can optimize your routes a lot better.”